Do I Need Earthquake Coverage?

Earthquake coverage is not covered by any regular policy. It is an option where people have the choice to add it to coverage or not. “Not” meaning that you assume all risks at your own expense. Let’s look at why this choice should be “YES” for earthquake insurance. Note: this applies to commercial businesses as well as homeowners, tenants and condo unit owners.

1. Lack of Government Assistance

The Government will not help you. As it is an insurable option, the government has no obligation to help you. Temporary relief may be provided to help the public, but when it comes to rebuilding your home, business or replace your contents, you are on your own. This is one of the largest costs an individual may incur when their home is damaged by an earthquake.

2. Repairing Damage is Expensive

So who will pay for all your Earthquake losses? If you are able to start from scratch and fund it all by yourself, awesome, then you might be okay without earthquake insurance. But because of the high costs of repairing or rebuilding your home, as well as replacing any destroyed contents, transferring your risk onto an insurance company is the best option to protect your property..

3. Temporary Living Expense

Now you may be asking yourself how will earthquake insurance help me right after an earthquake if one happens? That is where the temporary living expense, that comes with your earthquake insurance comes into play. the temporary living expense will help you get someplace to live after an earthquake, in the event that your home is no longer suitable to live in. While your insured home is being rebuilt, additional living expenses, as extended with earthquake insurance, will provide the temporary living costs while you wait to move back in, or decide to relocate.

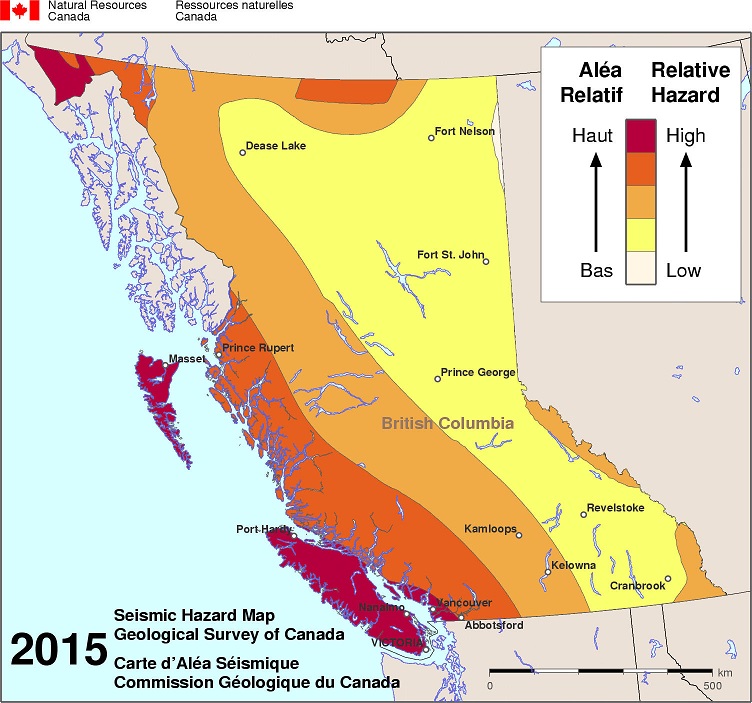

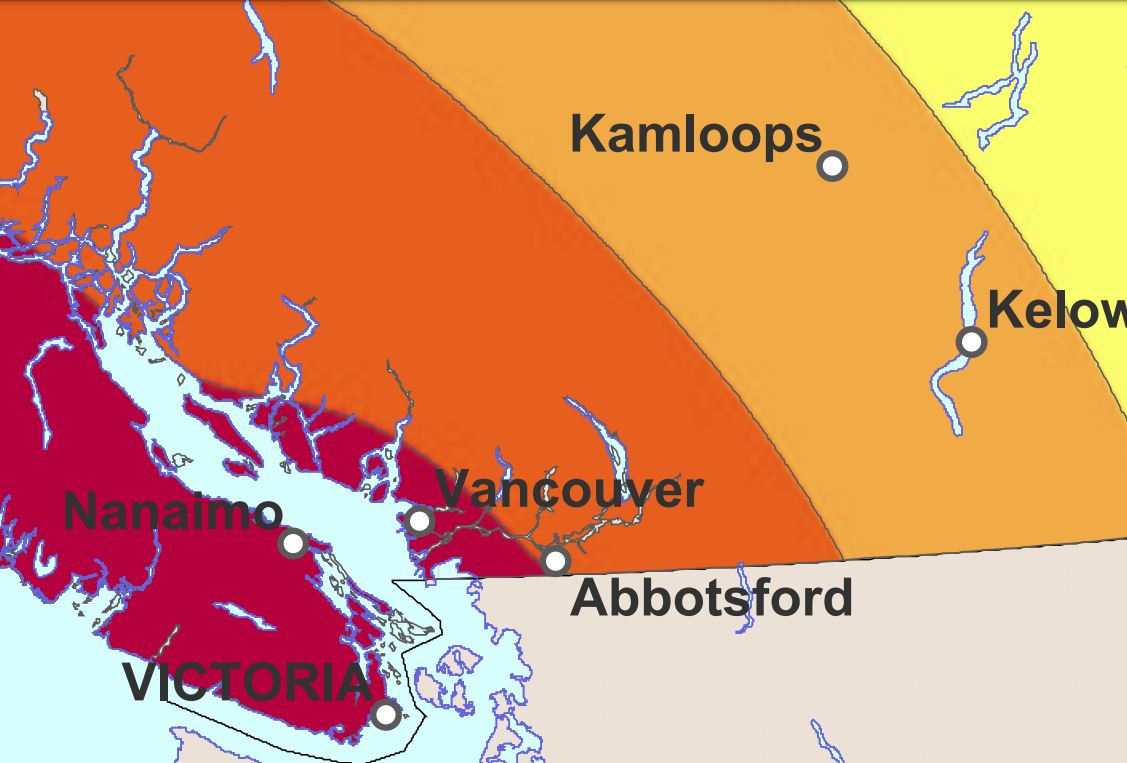

4. Earthquake Frequency

British Columbia is within an earthquake zone and is one of the most seismically active regions in Canada, according to Natural Resources Canada. We have approximately 400 measured earthquakes each year in BC. While most of these are small about once every year there is one big enough to damage a building somewhere in BC, many experts agree that a large earthquake is overdue.

5. Not A Part of Every Insurance Policy

Earthquake insurance is not an automatic part of your home or business insurance policy, it can be included as optional coverage. Earthquake coverage will usually target not only the building but also the full or partial contents inside of it as well. If you get earthquake insurance, which we recommend, make sure that you transfer as much earthquake risk as you can to your insurance company.

6. Earthquake Insurance is Not Very Expensive

Does Earthquake Insurance cost a lot? Outside of the basic policy, Earthquake coverage is the cheapest coverage, dollar for dollar offered by insurance companies. For example, jewelry rates are about 25 times as much, tool rates can be about 40 times more per replacement dollar. However, you are buying a lot of earthquake coverage, adding the replacement cost of your home and contents. For many homeowners, that coverage exceeds a million dollars.

7. Insurer’s Capacity To Pay Claims

Will the insurance company be around to cover your loss? Yes, Insurance companies have carefully priced and structured Earthquake Insurance coverage, along with careful monitoring, or mapping their exposures. Catastrophe coverage is usually insured up the chain to large world reinsurance companies, and Federal Government financial regulations monitoring through accounting key performance indicators to ensure that insurance companies can meet their obligations to pay your earthquake claims.

8. You Can Lower Your Premium

There are ways that you can get your premium or the amount you pay for your insurance, lower. The simplest way to reduce the cost of your insurance policy is to increase your deductible. One way to reduce the insurance company’s obligation is through deductibles, often 10% in Earthquake zones, less in less risky areas. Newmarket options are to buy a separate ‘gap’ policy to cover the deductible amount with a separate insurer.

9. Protect Your Valuables as Someone Renting

Tenant and Condo owners have no building to insure, but still, have the need to cover contents and all-important Additional Living Expenses. The dollar amount of everything you own may surprise you but the low price for this coverage may surprise you even more.

In Conclusion

For these reasons the licensed insurance brokers at Nexus Insurance brokers would recommend that you buy earthquake insurance in order to protect your home and the contents inside if it is not already part of another insurance policy.

While this is a brief snapshot of the reasons why you may need to purchase an earthquake policy, there are many other little extensions or exclusions in your policy.

If you would like to purchase an earthquake policy you can get one through nexus insurance brokers by calling us at 604-420-2501 or by email at info@nexusinsurancebrokers.com for any help with your policy. Our office hours are 8:30 am – 4:30 pm pst Monday to Friday.